Unlocking Financial Stability: An In-Depth Look at the U.S. Guaranteed Basic Income (GBI) Programs

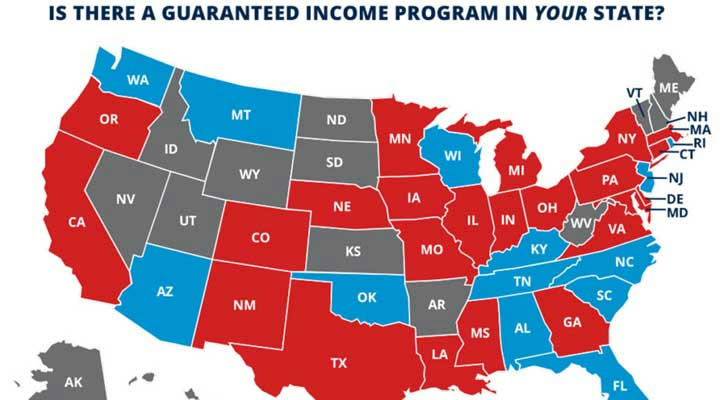

In recent years, the concept of Guaranteed Basic Income (GBI) has gained significant traction across the United States. These programs aim to provide recurring, unconditional cash payments to individuals, offering a safety net and promoting financial stability. This article delves into the overview, details, participation process, application avenues, beneficiary stories, and the benefits and potential pitfalls of GBI programs, supported by authoritative sources and real-life examples.

Overview of Guaranteed Basic Income Programs

Guaranteed Basic Income (GBI) refers to initiatives that provide regular, unconditional cash payments to individuals, typically targeting specific demographics or income brackets. Unlike traditional welfare programs, GBI payments come with no strings attached, allowing recipients the freedom to allocate funds as they see fit. These programs are designed to alleviate poverty, reduce income inequality, and empower individuals to make choices that best suit their needs.

Details of GBI Programs

GBI programs vary in structure, duration, and funding sources. Key aspects include:

Payment Amounts: Monthly stipends range from $500 to $1,000, depending on the program and location.

Duration: Programs typically run between 12 to 24 months, with some extending up to 36 months.

Eligibility Criteria: Eligibility often focuses on income thresholds, residency requirements, or specific demographics, such as single parents or marginalized communities.

Funding Sources: Funding can stem from private donations, non-profit organizations, or municipal budgets.

How to Participate in GBI Programs

Participation in GBI programs generally involves the following steps:

Stay Informed: Monitor local government announcements, community organizations, and news outlets for information on upcoming or existing GBI programs in your area.

Check Eligibility: Review the specific eligibility criteria for the program, which may include income limits, residency requirements, or demographic factors.

Application Process: Complete the application form, providing necessary documentation such as proof of income, residency, and identification.

Selection Process: Some programs use lotteries to select participants, while others may prioritize based on need or first-come, first-served basis.

Program Participation: If selected, comply with any program guidelines and provide feedback or participate in evaluations if requested.

Where to Apply for GBI Programs

Applications for GBI programs are typically managed by local government agencies or partnering non-profit organizations. Interested individuals should:

Visit Official Websites: Check municipal or county websites for announcements and application details.

Contact Community Organizations: Reach out to local non-profits or community centers that may assist with the application process or provide information on available programs.

Utilize Social Services: Engage with local social service departments that often have information on financial assistance programs, including GBI initiatives.

Beneficiary Stories: Real-Life Examples

Stockton Economic Empowerment Demonstration (SEED)

Launched in 2019, the SEED program in Stockton, California, provided $500 monthly payments to 125 residents over 24 months. Participants reported increased job stability, higher incomes, and enhanced ability to afford essential expenses and job training. Additionally, programs like Stockton and Baltimore witnessed an overall increase in employment among participants.

Los Angeles County's "Breathe" Program

In Los Angeles County, the "Breathe" program expanded to provide 2,000 residents with $500 monthly payments for up to 18 months, specifically targeting foster youth aged 18-21. These no-strings-attached payments aim to help recipients achieve financial stability, primarily used for necessities like food and household goods.

Benefits of GBI Programs

GBI programs offer several advantages:

Financial Stability: Unconditional cash payments provide a safety net, enabling recipients to cover basic needs such as housing, food, and healthcare.

Economic Mobility: Additional income allows individuals to invest in education, job training, or starting a business, promoting upward mobility.

Mental and Physical Health: Financial security can reduce stress and associated health issues, leading to improved overall well-being.

Community Benefits: Increased disposable income can stimulate local economies through higher spending on goods and services.

Potential Pitfalls and Criticisms

Despite the benefits, GBI programs face criticisms and potential challenges:

Work Disincentive: Critics argue that unconditional payments may discourage employment. However, evidence from various GBI pilots suggests otherwise. For example, participants in Austin's UpTogether pilot reported increased job stability, higher incomes, and enhanced ability to afford essential expenses and job training.

Financial Sustainability: Funding large-scale GBI programs may strain public budgets, necessitating higher taxes or reallocation of resources from other social services.

Inflation Concerns: Injecting additional cash into the economy could potentially lead to inflation, diminishing the purchasing power of the payments.

Targeting Efficiency: Some argue that resources should be directed specifically to those in need rather than providing universal payments, to ensure efficient use of funds.

Conclusion

Guaranteed Basic Income programs represent a transformative approach to social welfare, aiming to provide financial stability and promote economic equality. While challenges and criticisms exist, early pilot programs have demonstrated promising outcomes, including increased employment and improved well-being among participants. As more data becomes available, policymakers can refine these initiatives to maximize benefits and address potential drawbacks, paving the way for a more equitable economic future.

Note: For the most current information on GBI programs and application processes, please refer to official local government websites and reputable news sources.