2025 Coin and Precious Metal Investment Guide: A Path to Financial Security

In recent years, the value of coins and precious metals has skyrocketed, making them one of the most stable and value-preserving investment options available. According to a 2023 report by the World Gold Council, gold prices have increased by over 15% annually since 2020, while rare coins have seen even higher appreciation rates. Despite their potential, many investors shy away from this market due to a lack of knowledge about coins, precious metals, and market trends. This guide aims to demystify this lucrative investment avenue and provide actionable insights for beginners and seasoned investors alike.

Investable Precious Metals and Coins: What You Need to Know

The most common precious metals and coins with investment potential include:

Gold: A timeless store of value, gold is available in bars, coins (e.g., American Eagle, Canadian Maple Leaf), and ETFs. The World Gold Council notes that gold has outperformed many traditional assets during economic downturns, making it a reliable hedge against inflation.

Silver: Known as "poor man's gold," silver is more affordable and widely used in industries, adding to its demand. Popular options include American Eagle silver coins and Canadian Maple Leaf silver coins.

Platinum and Palladium: These rarer metals are essential in automotive and industrial applications. Their limited supply and growing demand make them attractive investments.

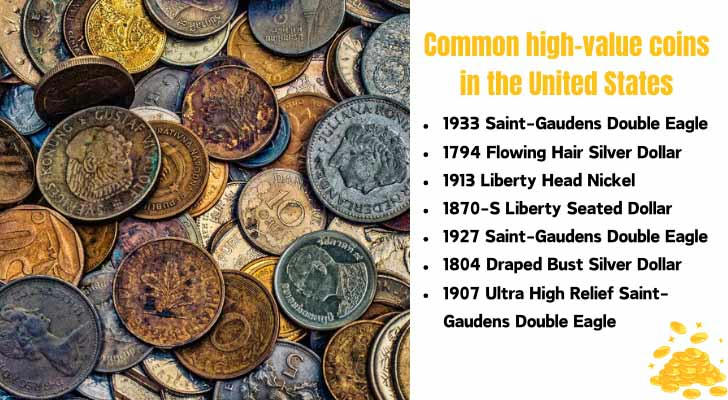

Rare Coins: Historical and limited-edition coins, such as the 1909-S VDB Lincoln Cent or the 1933 Double Eagle, can fetch millions at auctions due to their rarity and historical significance.

These assets are favored for their tangible value, liquidity, and ability to preserve wealth during economic uncertainty.

How to Assess Your Coins' Investment Value and Choose the Right Strategy

Not all coins are created equal. To determine if your coins have investment potential, consider:

Rarity: Limited mintage or historical significance increases value.

Condition: Coins graded by professional services like PCGS or NGC often command higher prices.

Market Demand: Research recent auction results and market trends.

For beginners, a balanced approach is recommended:

Physical Ownership: Purchase gold or silver coins/bars for direct ownership.

ETFs and Mutual Funds: Invest in funds like SPDR Gold Shares (GLD) for exposure without storage concerns.

Mining Stocks: Consider companies like Barrick Gold or Newmont Corporation for leveraged exposure to metal prices.

Diversification: Allocate 5-10% of your portfolio to precious metals and coins to mitigate risk.

Success Stories: Turning Coins and Metals into Wealth

John's Gold Investment: In 2020, John purchased 10 ounces of gold at $1,800 per ounce. By 2023, gold prices surged to $2,100 per ounce, earning him a profit of $3,000—a 16.7% return.

Sarah's Rare Coin Discovery: Sarah inherited a 1916-D Mercury Dime, which she later sold at auction for $25,000—a staggering return on an initially overlooked asset.

These stories highlight the potential of coins and precious metals to not only preserve wealth but also generate significant returns.

Why You Should Invest in Coins and Precious Metals Today

With inflation eroding the value of traditional savings and bank accounts offering minimal interest, coins and precious metals offer a tangible and historically proven alternative. According to a 2024 report by Bloomberg, gold is projected to reach $2,500 per ounce by 2025, while rare coins continue to appreciate due to their scarcity.

Don't let your savings lose value—invest in coins and precious metals today. Start small, educate yourself, and watch your wealth grow steadily over time.

Sources:

- World Gold Council, 2023 Report

- Bloomberg, 2024 Precious Metals Outlook

- PCGS Coin Grading Standards, 2023